Australia’s Digital Platforms Inquiry

26.08.2020Introduction

The Digital Platforms Inquiry undertaken by Australia’s competition regulator, the Australian Competition and Consumer Commission (ACCC), during the period from December 2017 to June 2019 was one of the most comprehensive conducted to that time. It was commissioned by the Australian government because of the recognition that major digital platforms were dominating the Australian media and advertising landscape and transforming the way in which Australians were engaging both socially and economically. It further recognized that current legislation and regulation may well have become ineffective when dealing with the new issues for competition and consumer protection that have arisen as a result.

Terms of reference

The inquiry was commissioned by the Australian Treasurer (the relevant minister) on December 4, 2017 and was concerned with the impact of online search engines, social media, and digital content aggregators on competition in the media and advertising services markets, and on consumers and participants in those markets.

Focus on Google and Facebook

The inquiry naturally focused on the two largest digital platforms in Australia, Google and Facebook. In its preliminary report, the ACCC reports monthly usage for a total population of 25 million as follows: “The use of these platforms has grown substantially over the past ten years and they are now an integral part of life for most Australians. Each month, approximately 19 million Australians use Google Search, 17 million access Facebook, 17 million watch YouTube (which is owned by Google) and 11 million access Instagram (which is owned by Facebook)” (ACCC 2018: 3).

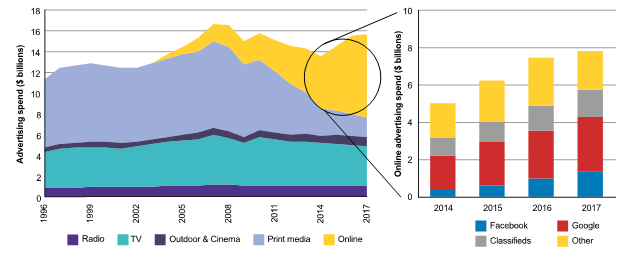

The impact of digital platforms on media advertising has been pronounced, as shown by the figure above. Although the data shown is from Australia, the position is indicative of what is happening globally.

Conclusions and recommendations

The ACCC prepared a final report in June 2019 (ACCC 2019). The report concluded that Google has substantial power in the market for digital search services, with 94 per cent of online searches, and in referral traffic in relation to news media businesses. It concluded that Facebook had substantial power in the market for social media services, and had 46 per cent of the Australian display advertising market by revenue compared to the next largest participant with less than 5 per cent (ACCC 2018: 4).

The ACCC also concluded that the role associated with the collection and analysis of data was important for preserving and increasing market power, but that the significant network effects associated with scale (ACCC 2019: 11) and strategic acquisitions by both platform operators were equally critical (ACCC 2018: 9).

The ACCC confirmed these conclusions in its final report (ACCC 2019: 8-9) and also the nature of the overall policy and regulatory response needed to address the consequences for competition and consumer welfare. The response was multipronged involving 23 separate recommendations, including:

- Updating Australia’s merger framework to require digital platforms with market power to notify acquisitions before they are implemented.

- Addressing the default bias in relation to search engines and Internet browsers to enable more meaningful choice.

- Opening up data and make provision for informed choice in relation to data collection and storage by the consumers concerned.

- Reducing the risks that are faced by online advertisers, including the lack of transparency, self-preferencing and potential anticompetitive conduct by platform operators, and the need for monitoring and oversight by regulatory agencies.

- The need for a more detailed and probing investigation into so-called “ad tech” services.

- Developing codes of media conduct that are platform neutral.

- Development of digital platform codes as extensions to existing consumer protection codes.

- Review of privacy legislation with online transactions and digital platforms in mind, including mandatory take-down standards and the development of platform dispute resolution processes, including the possible establishment of a digital platforms ombudsman.

One of the most important conclusions, that underpins the future work that the ACCC foresaw as being necessary in this area, related to the capacity of competition regulatory agencies to effectively intervene in the online economy. The report recommended that a digital platforms branch be established to ensure that appropriate resources could be brought to bear on all issues as part of ongoing work of the ACCC.

Government response

The Australian government formally responded in December 2019 and in effect accepted all of the recommendations to be implemented via a roadmap. In particular, the government set aside AUD 26.9 million to fund the new digital platforms division of the ACCC and to resource further work needed.

Wider significance

The Digital Platforms Inquiry is significant as one of the more comprehensive reviews into the competition and consumer issues posed by digital platforms and the social and economic transformation that results from their widespread adoption. The review shows that legacy policy settings and regulatory approaches need to be augmented across a wide range of issues in order to address the risks to consumer welfare and to competition that arise. The specific combination of elements that make up the national response in any country may vary, but many of the elements will be common. The need for specific focus and for resourcing within competition agencies to enable them to develop the experience and skills needed for working in platform markets are likely to be priorities in all jurisdictions.

References

ACCC (Australian Competition and Consumer Commission). 2018. Digital Platforms Inquiry: Preliminary Report. Canberra: ACCC. https://www.accc.gov.au/focus-areas/inquiries-ongoing/digital-platforms-inquiry/preliminary-report.

ACCC (Australian Competition and Consumer Commission). 2019. Digital Platforms Inquiry: Final Report. Canberra: ACCC. https://www.accc.gov.au/focus-areas/inquiries-ongoing/digital-platforms-inquiry/final-report-executive-summary.

Last updated on: 19.01.2022