M&A activity of the main digital platform providers

30.08.2020Introduction

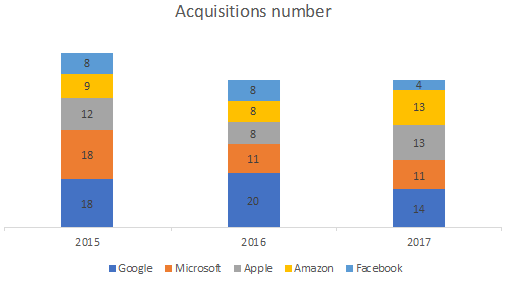

In recent years, the main digital platform providers have been considerably active in the field of mergers and acquisitions (M&A). Over the period 2015-2017, the leading digital platforms, Google, Apple, Facebook, Amazon, and Microsoft (GAFAM) acquired 175 companies (Gautier and Lamesch 2020). This intense M&A activity of the main digital platforms has brought to the forefront the adequacy of existing merger control tools. Can M&A regulation be tightened so as to prevent the digital platforms retaining and extending their already substantial market power?

Source: Gautier and Lamesch 2020.

Are regulators watching?

Some of the M&A activity of GAFAM (and of other digital platforms) has been investigated by antitrust authorities. For example, the merger between Apple and Shazam (2018) was investigated by the European Commission at the request of six EU member states; Microsoft/LinkedIn (2016), Facebook/WhatsApp (2014), and Google/Doubleclick (2008) were scrutinized by the European Commission; and so were the mergers between Facebook/Instagram (2012) and Google/Waze (2013) by the U.K. Office of Fair Trading. However, these are the exceptions to the general rule that competition authorities have not investigated the vast majority of GAFAM acquisitions, and even in these examples where they did investigate, the mergers were ultimately approved.

One of the reasons that few of the transactions are scrutinized by antitrust authorities is because the acquired firm is often too small and therefore its revenue usually falls below the threshold needed for a premerger notification.[1] Nevertheless, they add to the already considerable market power of large digital platforms and this raises concern among authorities. These strategic moves by large platform providers are now seen as suspicious “killer” acquisitions: the acquisition of small but promising startups, or increasingly threatening competitors, to restrict emerging competition or even worse eliminate potential market disruptions. A recent study on the effects of acquisitions on innovation (Bourreau and de Streel 2020) has demonstrated that large digital platforms have an incentive to buy out entrants in order to reduce potential future threats. Furthermore, if start-ups are sold to market leaders rather than to their rivals, this also strengthens their leadership.[2]

Is there a real concern?

A recent study for the U.K. Competition Market Authority (Argentesi and others 2019) analysed the characteristics of M&A activity carried out by the main digital platforms, to try to understand whether they reveal any reason for these concerns. The paper analysed the publicly disclosed acquisitions carried out by Amazon, Facebook, and Google between 2008 and 2018. Over this period, Google, Facebook, and Amazon acquired a total of 299 companies. The main finding of the study is that acquisitions most often target companies which belong to a broad range of economic sectors and whose products and services are complementary to those supplied by the acquirers. Acquisitions that can be defined as horizontal in nature appear to be in the minority. Therefore, they did not find evidence of widespread “killer” acquisitions. To what extent this also applies in vertical markets, where a platform may eventually want to expand remains to be seen.

The same conclusion has been reached in other recent studies. One study by Cabral (2020) found that, of about 800 acquisitions by Google, Amazon, Facebook, and Apple since 2000, the vast majority likely were motivated by complementarities between incumbent and entrant’s products or services. In another study (Gautier and Lamesch 2020), the authors examined the 175 acquisitions by GAFAM during the period 2015-17 using a set of predefined criteria, and the authors found only one of these acquisitions could be considered a possible “killer”: this was Facebook’s acquisition in 2016 of Masquerade, a young start-up that had developed a photo filter app. They concluded that most of the acquisitions were driven by a desire to strengthen the large platforms’ existing business segments such as valuable innovations, functionalities, R&D assets, or even hiring talent. This strategy allows them to reinvigorate their already strong market positions.

The proposed merger between Google and Fitbit is a case in point. The European Consumer Organisation (BEUC 2020: 1) points out that acquiring Fitbit would “further strengthen Google’s dominance in online advertising, search and other digital markets” while at the same time “the loss of Fitbit as an independent player would eliminate the opportunity of a potential challenger to Google’s powerful position.” BEUC therefore sees the merger as “a test case for the European Commission in terms of analyzing the effects on competition of large-scale data accumulation through acquisitions.”

What can be done?

In spite of the paucity of economic evidence of harm, competition authorities, which have the power to block an anticompetitive merger, are looking for new weaponry. Several countries, specifically Germany and Austria, have recently modified their M&A notification thresholds,[3] including a reference to the transaction value. The idea is that the purchase price better reflects the perceived amount of threat for the acquirer than its current turnover. The aim is to be able to scrutinize a higher number of M&A transactions whenever a wide gap exists between the price paid and the target turnover. However, as both the CMA study and the CESifo paper also concluded, the majority of acquired firms are very young (on average, in the case of Google, the most active platform regarding M&A activity, it has been about four years). It is extremely hard to predict where these businesses are heading and to what extent they may become a real threat to incumbents not to mention how long this can take.

It has been suggested that, for the largest digital platforms, mergers with “uniquely likely future competitors should be presumed to be unlawful.” This idea has been examined in a recent U.S. paper (Stigler 2019), which argues that such a formulation achieves nothing because it is almost impossible to identify a “uniquely likely future competitor” in these industries as future business models are extremely hard to predict. Cabral (2020: 10) similarly concludes that reforming merger and acquisition policy should be addressed with caution, and instead, priority should instead be given to “checking for abuses of dominant position, tightening consumer protection, and directly regulating dominant firms, not pre-emptive merger policy.”

The supporters of stricter rules towards potential killer acquisitions suggest a number of changes to the existing competition laws in what concerns the merger control regime:

- a revision of the merger control thresholds to capture a higher number of transactions at an early stage;

- a transaction value such as the one implemented in Germany and Austria,[4] and,

- a shifting to the acquirer of the burden of proof that the acquisition is procompetitive and objectively justified.

Also, in a cautious manner, some suggest the initial experience of Germany and Austria with the introduction of the transaction value threshold be monitored before implementing a change in merger rules in EU legislation. A report at the request of the German Federal Ministry for Economic Affairs and Energy (Commission “Competition Law 4.0” 2019) discusses in detail the competition issues arising from digital platforms and presents specific recommendations regarding merger control.

Endnotes

- But it is always open to the competition authorities to investigate other mergers below the threshold or after the event, in most jurisdictions. However, they seldom do. ↑

- It is worth noting that the start-up owner may also want to maximize the sale price, and the market leader may be in best position to pay the most. This could be part of the entrepreneurial motivation. ↑

- See Digital Regulation Platform thematic section on “Amending German competition law for digital regulation.” ↑

- Germany set its threshold at EUR 400 million while Austria set its threshold at EUR 200 million. ↑

References

BEUC (The European Consumer Organisation). 2020. Google-Fitbit Merger: Competition Concerns and Harms to Consumers. Brussels: BEUC. http://www.beuc.eu/publications/beuc-x-2020-035_google-fitbit_merger_competition_concerns_and_harms_to_consumers.pdf.

Gautier, Axel, and Joe Lamesch. 2020. Mergers in the Digital Economy. Munich Society for the Promotion of Economic Research (CESifo). https://www.cesifo.org/DocDL/cesifo1_wp8056.pdf.

Bourreau, Marc, and Alexandre de Streel. 2020. Big Tech Acquisitions Competition and Innovation Effects and EU Merger Control. Centre on Regulation in Europe (CERRE). https://www.cerre.eu/sites/cerre/files/20.02.04_issue_paper_big_tech_acquisition_rev-formatted2.pdf.

Argentesi, E., P. Buccirossi, E. Calvano, T. Duso, A. Marrazzo, and S. Nava, 2019. Assessment of Merger Control Decisions in Digital Markets: Evaluation of Past Merger Decisions in the UK Digital Sector. Study by Lear for the Competition and Markets Authority. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/803576/CMA_past_digital_mergers_GOV.UK_version.pdf.

Commission “Competition Law 4.0”. 2019. A New Competition Framework for the Digital Economy. Berlin: Federal Ministry for Economic Affairs and Energy (BMWi). https://www.bmwi.de/Redaktion/EN/Publikationen/Wirtschaft/a-new-competition-framework-for-the-digital-economy.pdf?__blob=publicationFile&v=3.

Cabral, Luís. 2020. Merger Policy in Digital Industries, New York University and CEPR. http://luiscabral.net/economics/workingpapers/hightech2.pdf.

Stigler. 2019. Stigler Committee on Digital Platforms: Final Report. https://research.chicagobooth.edu/-/media/research/stigler/pdfs/digital-platforms—committee-report—stigler-center.pdf.

Last updated on: 19.01.2022